Financial Inclution and Financial Literacy

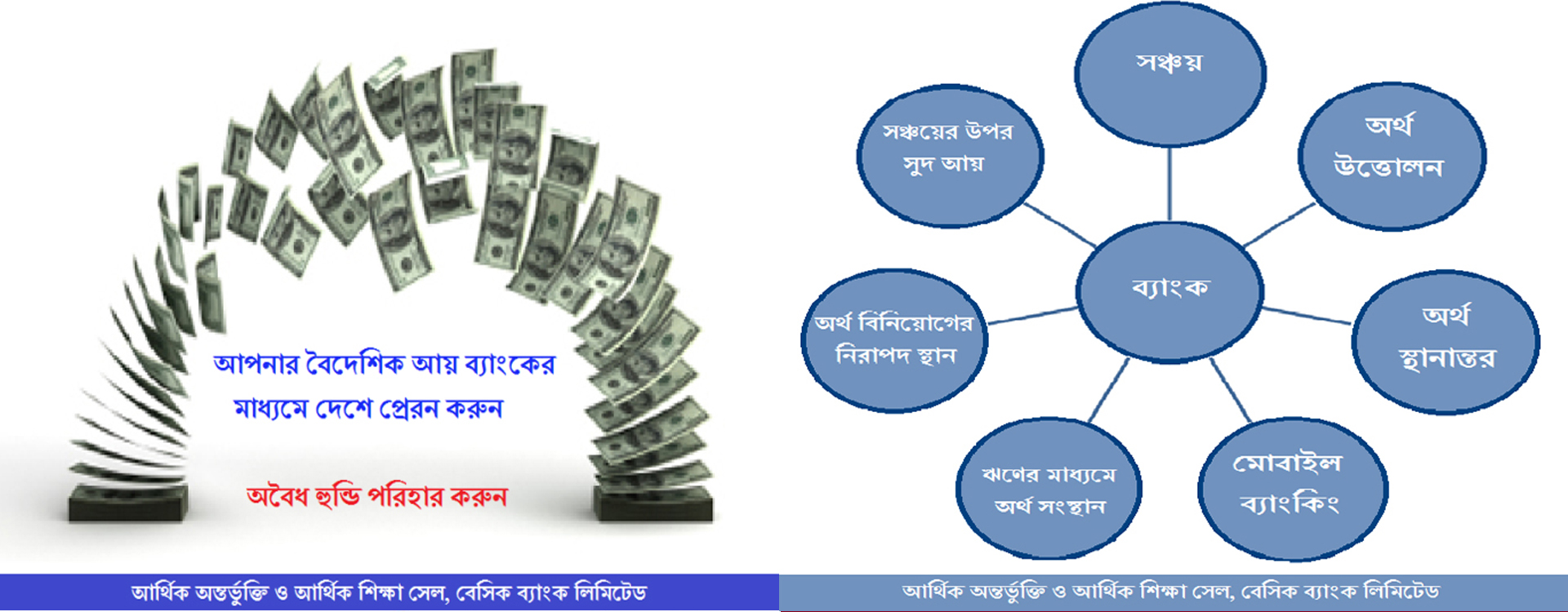

Bangladesh Bank has taken steps to bring all the disadvantaged, marginalized, extremely poor and low-income people of Bangladesh under the banking channel through financial inclusion in 2019. Under this, the disadvantaged and low income people of the society will be able to open their savings account through Taka 10/50 Taka / 100 Taka without any bank charges and fees. In order to conduct this work, Bangladesh Bank has directed to set up Financial Inclusion and Financial Education Cells at the head offices of all the banks. The Financial Inclusion and Financial Literacy Cell has been formed on April 30, 2015 at the head office of BASIC Bank in the light of the instructions of Bangladesh Bank..

As per the decision taken by Bangladesh Bank, necessary instructions have already been given to the branches and concerned departments of the head office for the implementation of financial education related activities. In order to expedite the financial inclusion and financial education activities directed by Bangladesh Bank, Basic Bank has already launched various savings schemes including significant School banking accounts, Farmer savings accounts, Ready made garment and Leather industry workers savings accounts, Muktijoddha savings accounts, Pathpuspa savings accounts, Grassroots. Savings account, basic Current account etc.

* Financial Inclusion and Financial Education Cell E-mail Number: basicfilc@basicbanklimited.com