|

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

At Year End

|

(Million Taka)

|

|

Total Loans and Advances

|

89,392.85

|

128,807.01

|

134,882.80

|

145,568.59

|

151,968.05

|

|

Total Investment

|

30,680.55

|

|

|

|

25,313.44

|

|

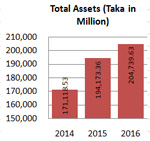

Total Assets

|

171,118.53

|

194,173.36

|

204,739.63

|

198,816.67

|

191,560.41

|

|

Total Deposits

|

139,934.06

|

148,167.23

|

158,070.98

|

143,180.24

|

131,821.58

|

|

Long-term Debt

|

2,673.97

|

2,482.94

|

2,325.16

|

2,198.15

|

7,082.11

|

|

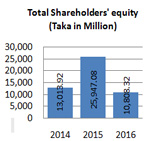

Total Shareholder's Equity

|

13,013.92

|

25,947.08

|

10,808.32

|

13,907.09

|

10,381.32

|

|

Financial Ratios

|

(Percentage)

|

|

Capital Adequacy Ratio *

|

(29.08)

|

(7.55)

|

(15.59)

|

(13.22)

|

8.25

|

|

Capital fund to deposit Liabilities

|

9.30

|

17.51

|

6.84

|

9.71

|

7.88

|

|

Liquid Assets to Total Deposit

|

12.03

|

16.88

|

10.86

|

13.60

|

7.75

|

|

Loan to total Deposit

|

82.46

|

84.72

|

83.62

|

100.25

|

109.45

|

|

Earning Assets to Total Deposit

|

54.14

|

70.47

|

73.50

|

67.50

|

68.70

|

|

After tax return on Average Assets

|

(0.67)

|

(1.72)

|

(7.49)

|

(3.39)

|

(1.81)

|

|

Net Profit to Gross Income

|

(7.28)

|

(27.27)

|

(125.12)

|

(64.47)

|

(36.92)

|

|

Interest Margin Cover

|

(50.36)

|

(115.46)

|

(39.29)

|

(6.52)

|

(41.11)

|

|

Return on Equity (after tax)

|

(11.55)

|

(12.10)

|

(81.24)

|

(55.38)

|

(21.08)

|

|

Industrial Loans including Micro

Enterprises to Total Loans

|

41.18

|

37.07

|

40.57

|

40.34

|

40.72

|

|

Non performing Loans to Total Loans

|

|

|

|

|

|

|

Per Employee

|

(Million Taka)

|

|

Deposit

|

62.55

|

68.50

|

74.14

|

68.08

|

63.53

|

|

Advance

|

39.96

|

59.55

|

63.27

|

69.22

|

73.24

|

|

Profit

|

(0.50)

|

(1.19)

|

0.04

|

0.17

|

(0.58)

|

|

Earnings Analysis

|

(Million Taka)

|

|

Total Income

|

15,113.56

|

11,514.96

|

11,932.41

|

10,615.17

|

9,586.44

|

|

Total Operating Expense

|

|

|

|

|

|

|

Profit before Tax

|

(1,124.38)

|

(2,564.25)

|

90.85

|

351.55

|

(1,200.56)

|

|

Income Tax

|

|

|

|

|

|

|

Net Profit after Tax

|

(1,100.16)

|

(3,140.36)

|

(14,930.40)

|

(6,843.69)

|

(3,538.95)

|

|

|